Call Us Today (877) 943-0100

What is a Certificate of Insurance? Answers from the Experts

COI Management | August 4, 2021

When contractors need to provide proof of their current insurance policy, they provide a certificate of insurance. But what is a certificate of insurance? Here is the answer from industry experts.

When you contract out work or products to another company, it introduces extra risk to your organization. Collecting and tracking insurance for your contractors and vendors is a great way to ensure that the associated legal and financial risks are more likely to be covered. Luckily, there is an easy way to confirm coverage and that it meets your requirements through the collection of a certificate of insurance (COI). Recognizing these benefits and how to interpret a COI is a critical first step.

Why Collect a COI?

Collecting a certificate of insurance provides a sense of security for your business or organization when working with a contractor or vendor. According to a survey of 30,000 small businesses, 44% of businesses who had been open for a year or more have never had insurance. Knowing that 99.7% of businesses are small businesses, this becomes an alarming number of potentially uninsured companies that you may be working with.

What is a Certificate of Insurance?

A COI contains basic details about the most common business insurance policies so you can verify that they have active insurance, and that the coverage is adequate for the type of work they perform. By asking for a COI, you can ensure that there is coverage in place to protect against accidents and lawsuits that are a result of the contractor’s negligence or a faulty product. Like collecting someone else’s car insurance when you get in an accident, if you have a COI in-hand, you will be better prepared with needed insurance details if you must report a claim.

If the contractor is slow or hesitant to provide you a COI, it is a sign that something is wrong and that they are possibly underinsured or not insured at all. Requesting a COI is common, and most insurance brokers and carriers issue them for free and in a timely manner.

Benefits of a COI

A certificate of insurance is typically a one-page document that is easy to read. Policy pages are the alternative which are difficult and slow to read. They vary drastically between insurance carriers, can be well over 100 pages, and provide additional details that would not pertain to your organization. Unlike the COI which is consistent and has information that is valuable to you.

Because a COI is so simple to read, it increases the efficiency and accuracy when verifying coverage. This helps to reduce the costs associated with collecting and verifying insurance coverage, making it easier to maintain a compliance program to shift financial risks and costs associated with accidents that involve your contractor.

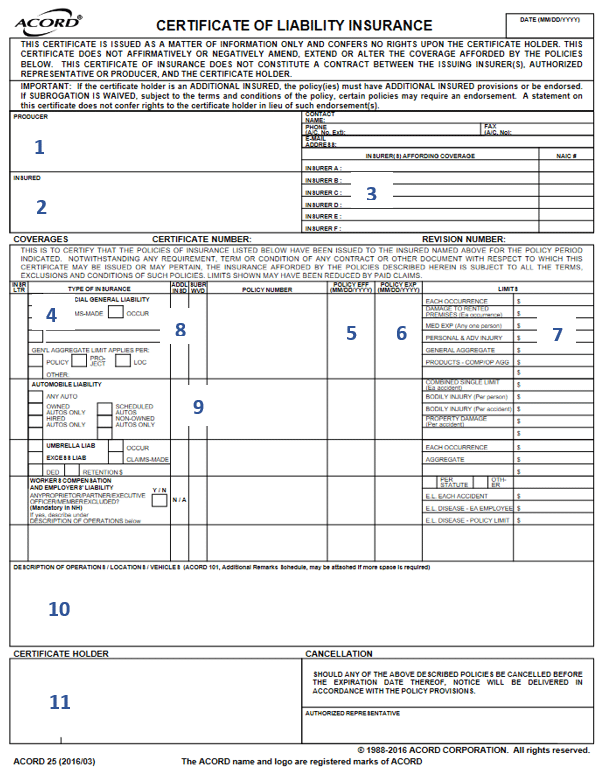

The Acord Form

The Acord 25 Form is the most common certificate of insurance used for businesses in the United States and was designed to standardize the various insurance forms that were previously being used. It was created and is maintained by a nonprofit organization that monitors state insurance regulations to ensure that the Acord Form complies with state laws.

Other Certificates of Insurance

There are other COIs used that provide similar details to the Acord Form and they are also acceptable to use for reference on insurance coverage. These forms are usually specific to a particular insurance carrier or state workers’ compensation funds where a business can only purchase workers’ comp through the state instead of through a private insurance broker or carrier.

How To Read a COI

A COI provides details for Commercial General Liability, Automobile Liability, Umbrella Liability and Workers’ Compensation. All policies that each business should obtain, at a bare minimum, to ensure they are properly protected from common business risks.

There is additional space to provide other policy types that are applicable to the business needs and that you may want to request if it applies to the work they are performing. For example, if your contractor performs asbestos work, you will want to confirm that they have a pollution policy because of

the related dangers. Below are some of the details that you can collect from an Acord 25 COI:

- Producer Name & Contact Info: The insurance agent or broker

- Insured’s Name: The policy holder name or the contractor

- Insurer Name: The insurance carrier who provides the insurance coverage

- Policy Types

- Policy Effective Date

- Policy Expiration Date

- Limits of Coverage: The maximum amount of money the carrier will pay towards a claim.

- Additional Insured: A flag that shows whether your organization is listed as another name insured. When this flag is present, the name of the additional insured is the certificate holder. Additional insured can also be noted in the description of operations.

- Waiver of Subrogation: A flag that shows when the carrier will not sue your organization for losses paid on behalf of the policy holder. When this flag is present, the name whose subrogation has been waived is the certificate holder. Waiver of subrogation can also be noted in the description of operations

- Description of Operations: An area that agents use to list description of operations, property, vehicles, and other details applicable to the policies

- Certificate Holder: The name of an organization who is entitled to receive renewal certificates of insurance. This should be the name of your organization when you request a COI

What is a certificate of insurance? Although a COI is designed for simplicity, it still requires someone who is knowledgeable about insurance and specific types of coverage to interpret the document accurately, especially if you have a need to track additional policy types such as various cargo types or garage policies where types of coverage and what applies becomes gray.

When Shouldn’t You Rely on a COI?

A COI is not a binding document and does not alter coverage. Just because the COI states that there is a certain type of coverage or that there is an additional insured or limits, does not mean that the policy has that exact same coverage. Insurance agents do their best to ensure that the coverage provided on the COI is as accurate as possible and they have an interest to do so because there are legal ramifications to providing false information.

If your organization has significant costs associated with denied claims or works in a high-risk industry where an accident is more likely to impact the financial wellbeing of your organization, it may be prudent to request endorsements or the policy pages to confirm details.

Endorsements are changes made to the policy such as additional insured status for your organization. By collecting the endorsements or policy pages you can confirm the actual coverage and more detail that may not be present on a COI to ensure your requirements are met. For example, you may want to be listed as an additional insured but specifically for completed and ongoing operations or specific to vendor products such as a broad vendor endorsement. With a COI, there is less of a guarantee that the additional insured endorsement is the one you want.

The collection of policy pages and endorsements can be time-consuming to read and confirm coverage. Because of this, it is more expensive than tracking COIs, especially if done accurately and by a qualified individual. As such, you should weigh the risks, costs, and benefits as well as consult a risk manager and your legal counsel to determine the need.

To Sum it Up

Collecting a COI is an important step to make certain that you work with companies who are appropriately insured to reduce and transfer your risk. Because of the simplicity of a COI, it creates a straightforward and economical approach to verify coverage and that it meets your organization’s requirements.

If you’re asking “what is a certificate of insurance?” It’s important to have someone who understands insurance and the COI is important to guarantee that the data is being interpreted correctly. Depending on your organizations’ risk level, it is important to be familiar with:

- Acord 25 Form

- Various certificates issued by carriers and workers’ comp state funds

- Endorsements

- Policy Pages

- Various aspects of insurance related to your requirements such as additional insured

Certificate of insurance tracking services are an integral part of a contractor compliance strategy. Contact PlusOne Solutions today to learn more about how we can help your organization.

Contents are provided for information purposes only and should not be construed as legal advice. Users are reminded to seek legal counsel with respect to their obligations and use of PlusOne Solutions services.

About PlusOne Solutions

For more than 16 years, PlusOne Solutions has been an industry leader in the risk management field by specializing compliance programs that meet the complex challenges of geographically dispersed contractors, vendors and employee networks. PlusOne Solutions protects companies from possible financial, legal and reputational risks associated with contractor and vendor relationships while creating safer work environments for everyone and is an Accredited Background Screening Agency by the Professional Background Screening Association.

To receive these updates directly in your email inbox, sign up for the newsletter. Questions or comments? We want to hear from you.What Type Of Insurance Should A Contractor Have? Types of Insurance to Track for Your Contractor and Vendor Networks

If you are searching “what type of insurance should a contractor have?” ...

Read MoreA COI Tracking Spreadsheet Can Come Back to Haunt You

If you have been searching for the perfect certificate of insurance (COI)...

Read MoreHow COI Tracking led to improved compliance and faster renewals for 10,000 contractors

The PlusOne Solutions Certificate of Insurance (COI) tracking and management program takes...

Read More